Financial services and customer-focused banking are experiencing a retail revolution. Customers are in control of their services more than ever, and prefer a more ‘bespoke’ approach to their interactions with their bank or financial services provider. Lining up in a bank, or waiting on the phone in an endless queue listening to canned music is not an efficient use of your clients’ valuable time. They expect better of you and your institution. They expect you to evolve with them.

Innovative technologies and Omnichannel Approach

Technology and the speed of engagement has altered many clients’ expectations. The account management function will evolve due to such technologies as AI, voicebots, and chatbots. Front-line account and fulfillment functions will be absorbed into these technologies, often circumventing a seasoned account manager. This will leave higher value account managers more time for their VIP or large investment clients.

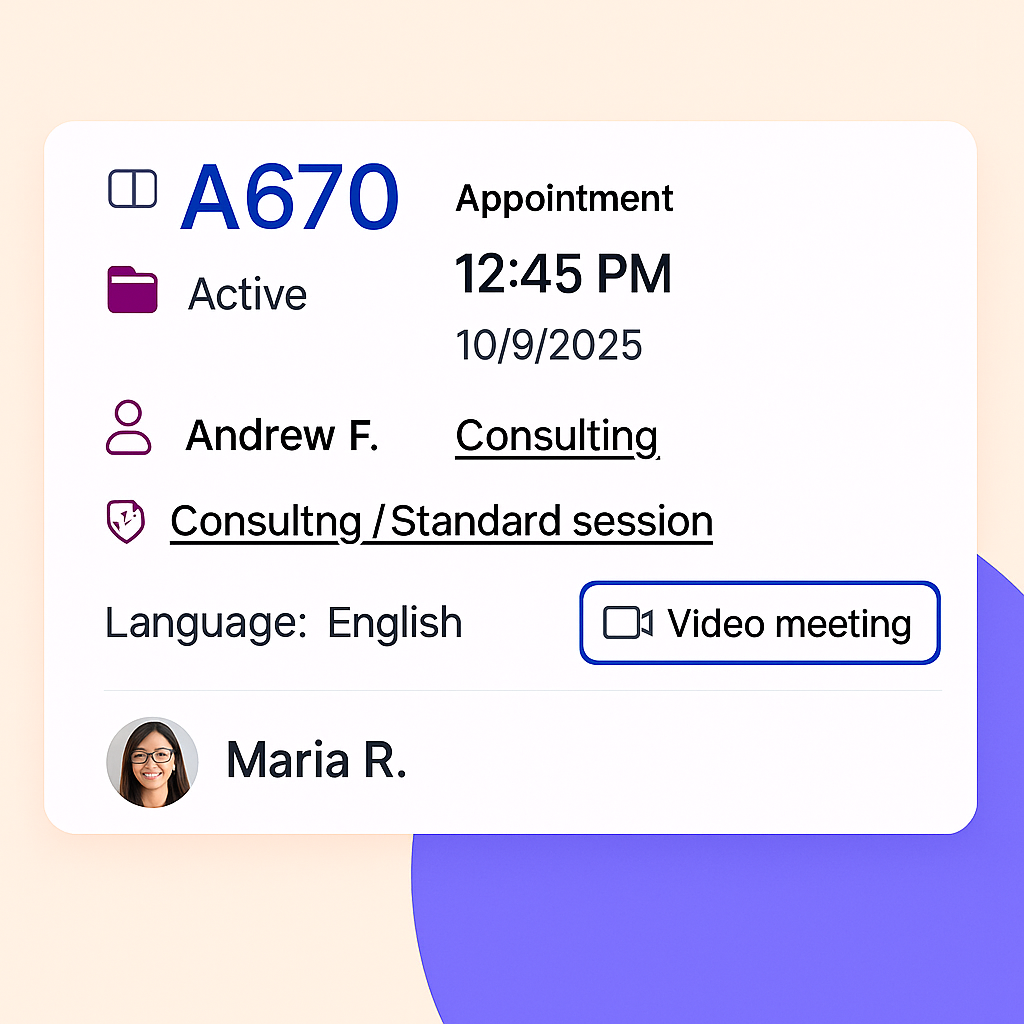

'New Retail' is the direction expected by your customers. They want to engage with organizations in a streamlined and comprehensive manner. A robust and positive customer journey starts in any channel and continues to flow efficiently and logically to another. This can be physical or virtual, in store or online (or even online in the store).

If financial institutions are to remain competitive and relevant, they need to seamlessly integrate all available channels and touchpoints, from web and mobile App, to phone and in-person services. Failure to meet customers’ expectations will lead to customers looking to more accommodating service providers, putting your revenues and services at risk.

Business Process Management in the banking and financial services retail arena provides a highly efficient, broad view of the services you provide. Services can be analyzed, refined, remodeled and shared based on the data gathered.

Customer Experience Optimization

To optimize the customer experience, a financial service organization needs to understand their customer base now, and in the future. Engaging tech-savvy millennials and maintaining services for an aging society who continue to proactively manage their assets and investments will ensure the institution is successful. Because a majority of customers indicate they prefer a hybrid investment model over either a dedicated ‘real person’ adviser or conventional automated advisory service offerings, it’s obvious that tech-based innovations and bullet-proof infrastructure should support (and not replace) human interaction.

While ‘New Retail’ seems like an exciting path to embrace, it is totally dependent on an organization’s ability to support and provision for these services. Having a portal or site down for a day will give the impression an organization is not ready to support their customers or they are not operating in a secure and robust manner. Should the organization go to a cloud solution for online services, it must be on a secure, dynamic and stable hosting service provider. This is not the place to nickel and dime!

Monitoring and Reporting

The data and reports you gather from your service activity will allow your organization to better understand what customers are doing, what they expect of you and if you are meeting their needs. This allows you to ensure your infrastructure, feature and functions and service offerings align with your customer demographic.

By understanding your services, customers and technology you are able to be ahead of the trends, while growing with your customers and meeting their changing needs. Customer satisfaction is the ultimate goal when assessing and realigning your service methodology and retail banking vision.

Read about Q-nomy’s solutions for the banking sector.

.webp)

.png)

.jpg)

.svg)